It is widely believed that gold prices reveal the overall health of the economy, and will continue to be an integral part of foreign exchange markets. Aside from the usual suspects (i.e., market activity, wealth reserves, or supply and demand), major events involving economic policy tend to affect gold prices.

The Federal Reserve Bank of Kansas City’s 44th annual economic policy symposium (i.e., the Jackson Hole Economic Symposium) was held online this year on August 27th and 28th. Its potential effect on gold prices has been widely covered in the news, with a series of policy changes announced going forward. It is expected to contribute to further US dollar depreciation. Historically, financial instruments related to the US dollar have price moves around the event.

Using the tool discussed below, analyzing economic data to observe trends surrounding major economic events leads to the potential to make educated predictions on gold price moves.

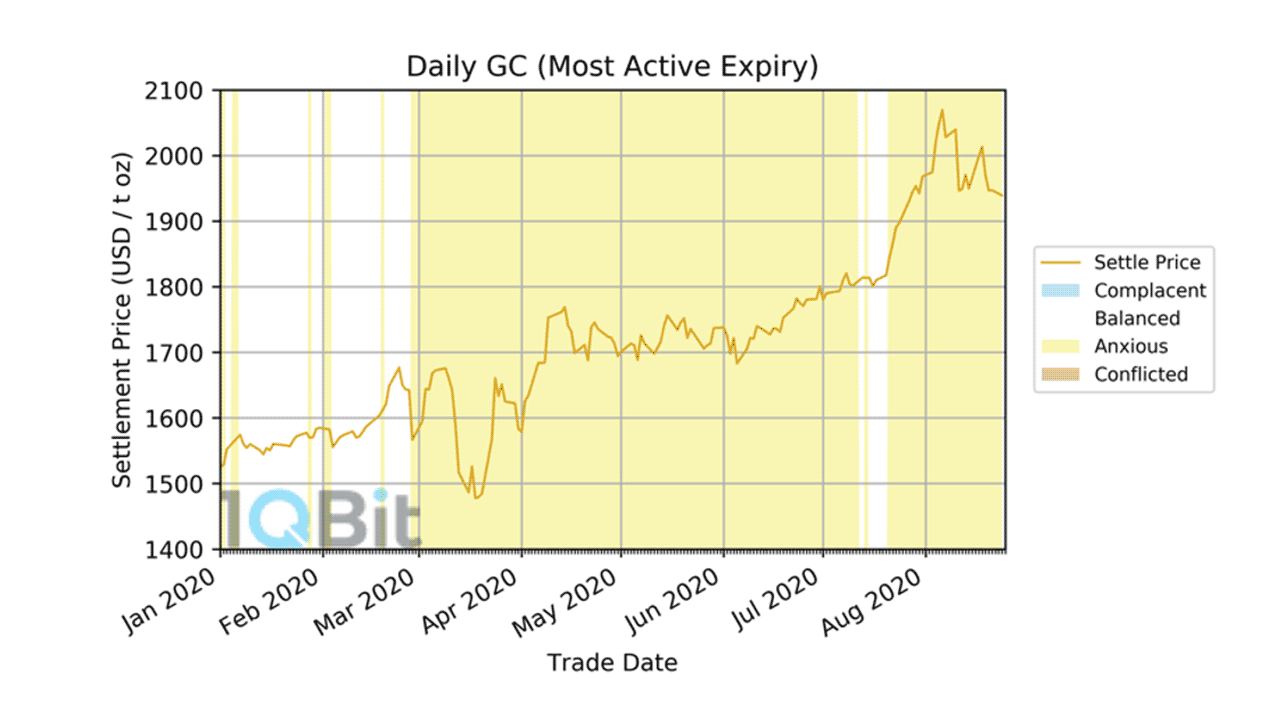

In order to analyze market sentiment and price moves for various futures and options, 1QBit partnered with CME Group to develop the CME Market Sentiment Meter (MSM), including daily updates on COMEX Gold futures and options. The sentiment state moved back and forth between the Balanced state and the Anxious state for most of 2020, as shown below.

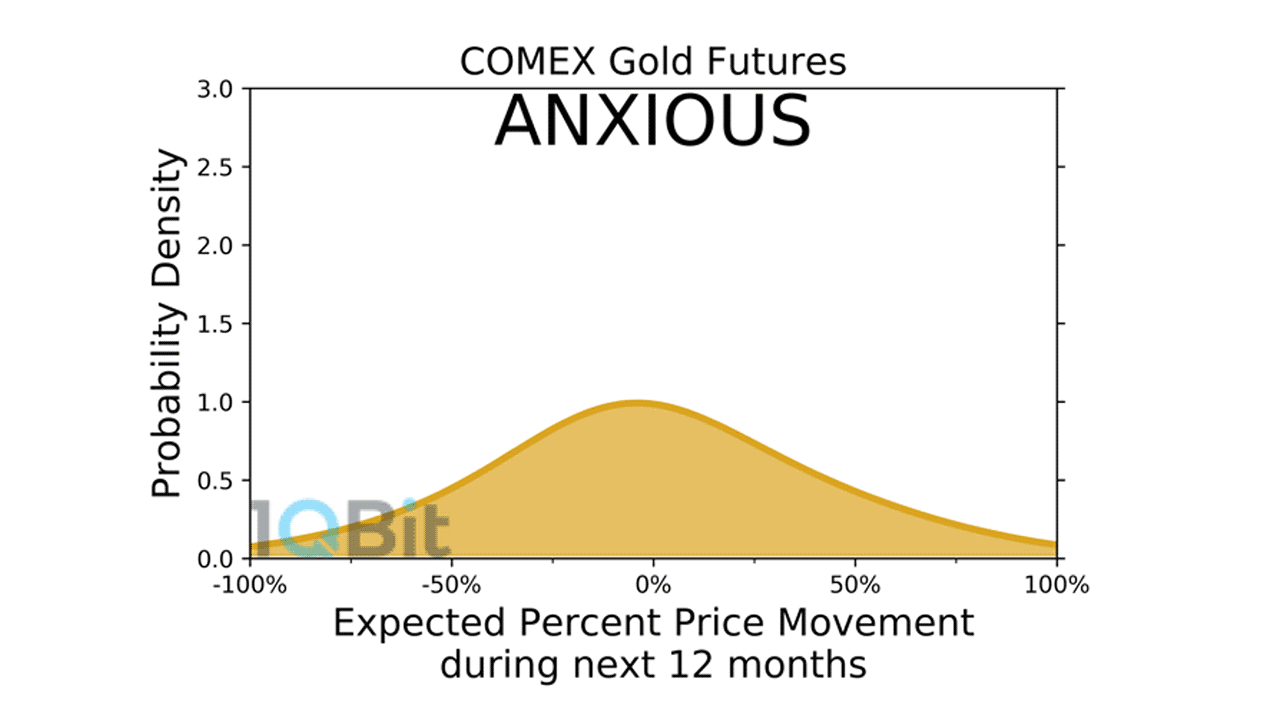

Interestingly, in the past, transitions from a long-lived Anxious state to a Balanced state have been accompanied by large price moves. The Anxious state’s corresponding MSM risk–return curve is shown below.

We invite the reader to examine our white paper analyzing COMEX Gold futures prices during the 2019 Fed Rate Cuts. There is a striking resemblance in the analysis of price moves. It leads to the question, “Is there the same pattern developing around the Jackson Hole Economic Symposium?”

This certainly merits further study, and shows the potential power of the MSM not only in analysis but also to help traders understand potential financial market movements. In fact, the MSM has shown that COMEX Gold has maintained an Anxious market state shortly following the symposium. As open-market days continue to unfold, analysis of the market should further validate the metrics provided by the MSM.

For live updates on all MSM markets, including COMEX Gold, please visit the MSM page on the CME Group’s website.

References

1 T. Jaschek, M. Bucyk, J. S. Oberoi, “A Quantum Annealing-Based Approach to Extreme Clustering”. In: K. Arai, S. Kapoor, R. Bhatia (eds.) Advances in Information and Communication. FICC 2020. Advances in Intelligent Systems and Computing, vol 1130. Sprinter, Cham. (2020).