The idea of making money by exchanging one type of currency with another is well-known. Many Canadians remember a time or two when the Canadian dollar was on par with, or even worth more than, the US dollar (USD), such as in 2007. Canadians revelled in the lower cost of goods south of the border. At the same time, people expected the value of the USD to rise again, so many held onto their US currency in order to sell it later. Events like these are rare between established countries, and returns are typically low for foreign exchange (FX).

For insights on the market sentiment for Gold, Crude Oil, or other major markets, visit the Market Sentiment Meter page. To set up a free trial, contact msm@1qbit.com.

The FX between emerging, or developing, countries can have higher returns than those of established markets because of faster economic growth. But, there is also higher risk because of possible turbulent social, political, and economic factors. Gaining insight into emerging FX rates is valuable for harnessing the potential of these emerging market instruments.

Market Anxiety Precedes FX Movement

Gold and crude oil are major commodities that are often traded in large volumes for emerging countries. The supply and demand for gold and crude oil can strongly affect FX rates. These commodities are typically traded as Gold futures (GC) and Crude Oil futures (CL) contracts. Futures contracts, or simply “futures”, are agreements to buy or sell something at a set price at some specific time in the future.

The price of futures is affected over time by market sentiment—the overall attitude of traders in a given market—which is subject to change based on major events, such as the COVID-19 pandemic. Market sentiment can be calculated using the CME Market Sentiment Meter (MSM). One type of market sentiment is the “Anxious” state, which simply means that for a given period of time schools of thought differ more than normal, and this difference could result in large price movements for the futures.

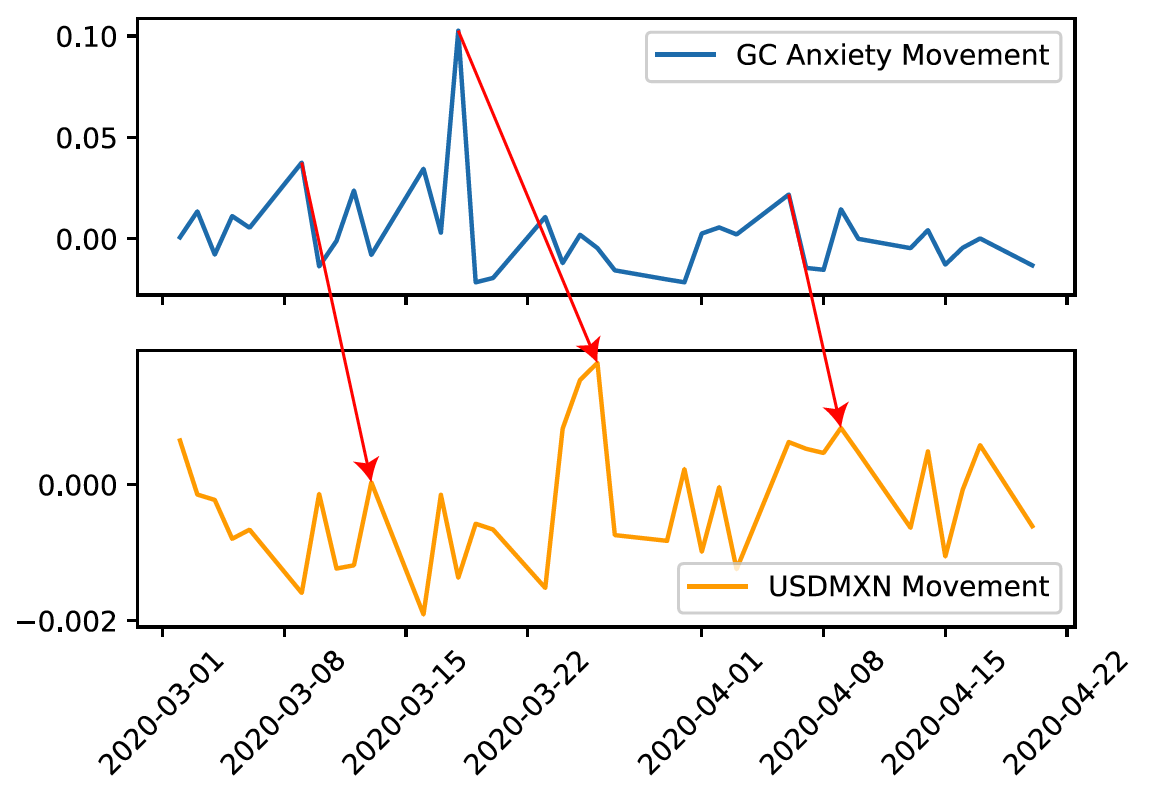

Figure 1: MSM anxiety in gold futures (top) and exchange rate for the Mexican Peso relative to the US Dollar reported in USD (bottom).

By visualizing GC and CL anxiety movements over time, a comparison can be made to emerging market FX rates. It is natural to wonder if these time series are related and, if so, what insight could be gained between them. In Figure 1, the changes in GC anxiety appear to precede the changes in the exchange rate (indicated by the red arrows), and motivate a more in-depth analysis.

It turns out that concrete insight on emerging market FX rates can be gained using statistical tests—known as Granger causality tests—using GC and CL market anxiety. A Granger causality test essentially asks the following question: will time series X have a noticeable effect on time series Y after some amount of time? In this case, time series X can be either GC or CL market anxiety (e.g., the top time series in Figure 1), and time series Y can be the emerging market FX rates (e.g., the bottom time series in Figure 1).

Granger causality tests were performed by 1QBit analysts Aaron He, Anish Verma, and Javad YaAli for both a time period before the COVID-19 pandemic and a time period during the pandemic. What did the tests show?

Putting It to the Test

The Granger causality tests were applied to a set of emerging currencies: the Turkish lira (TRY), the Mexican peso (MXN), the Brazilian real (BRL), and the Indian rupee (INR). The USD was used as the reference currency (i.e., the exchange rate between USD and TRY was represented using “USDTRY”, and so on). The USD-to-British pound (USDGBP) rate was used as a control. The Granger test is based on the concept of rejecting a null hypothesis, a well-known statistical technique. In effect, the tests attempted to confirm that movements in GC anxiety could be used to forecast subsequent changes in the emerging currency exchange rates.

Time series data was taken from Jan 3, 2012 to Dec 31, 2019, and represents the pre-COVID-19 period, and data from Jan 3, 2020 to Feb 24, 2021 represents the period beginning when the pandemic began.

The tests demonstrated that in the pre-COVID-19 period, anxiety movements of GC and CL do not show that there is any significant causal relationship, based on the Granger method, with exchange rate movements of emerging markets.

During the pandemic, GC anxiety movements had a significant causal relationship, based on the Granger method, with currency exchange rate movements for USDTRY, USDMXN, and USDINR. Similarly, CL anxiety movements preceded currency exchange rate movements for USDMXN, USDBRL, and USDINR.

For the control group, the effect of anxiety movements of GC and CL on USDGBP did not depend on whether the Granger tests were performed for the period before or during the COVID-19 pandemic.

In short, GC and CL market anxiety could be used to systematically forecast price movements of FX rates in developing countries, especially in the wake of the ongoing pandemic. By estimating these price movements, one has a better chance at making trades that increase profit and protect against losses.

Look for an upcoming white paper here for a more detailed analysis on Granger causality, and many other insights related to sentiment in major markets. To set up a free trial of the MSM, along with access to our team and exclusive resources, contact msm@1qbit.com.

Subscribe to the 1QBit Blog to keep up to date with other recent topics in finance, and in other areas involving advanced and quantum computing.