Large-scale events tend to affect the futures market. For example, demand for natural gas is affected by the weather. Demand is also affected by the patterns in people’s day-to-day lives, which have been greatly affected by the COVID-19 pandemic. In this article, we will look at a past event in the natural gas futures market, and explain why we should look for the same pattern toward the end of the present winter. The analysis is guided by the market sentiment tool, the CME Market Sentiment Meter (MSM).

Natural gas prices have a seasonal pattern based on the demand for heating. They can also be affected by the demand for electricity in severe weather conditions, such as winter storms. The producers and consumers of natural gas make use of the natural gas futures market to mitigate their risks. With another winter—this time during the COVID-19 pandemic—it is worth investigating how natural gas futures prices are being affected using the MSM.

The seasonal demand for natural gas has led to a unique distribution structure. In the United States, natural gas produced during the summer is stored in underground reservoirs, so that greater volume will be available to meet the winter demand.

Analyzing the Natural Gas Futures Market

The key in this analysis is to look at production and storage. We usually introduce MSM in its day-to-day form, as a dataset that contains risk–return estimates based on end-of-day settlement data from the previous day. The estimates come from probability distributions that reflect the presence of multiple schools of thought within the trading community.

“With another winter—this time during the COVID-19 pandemic—it is worth investigating how natural gas futures prices are being affected using the Market Sentiment Meter.”

However, the MSM also provides its subscribers with access to a library of “event narratives”, where changes in market sentiment states are related to external conditions and events. MSM event narratives are a good place to start when you are looking to understand a current market situation.

The natural gas market is volatile. Potentially, there is greater profitability in natural gas futures, but with this greater volatility comes greater risk. Against this greater risk, the trader should be armed with greater information.

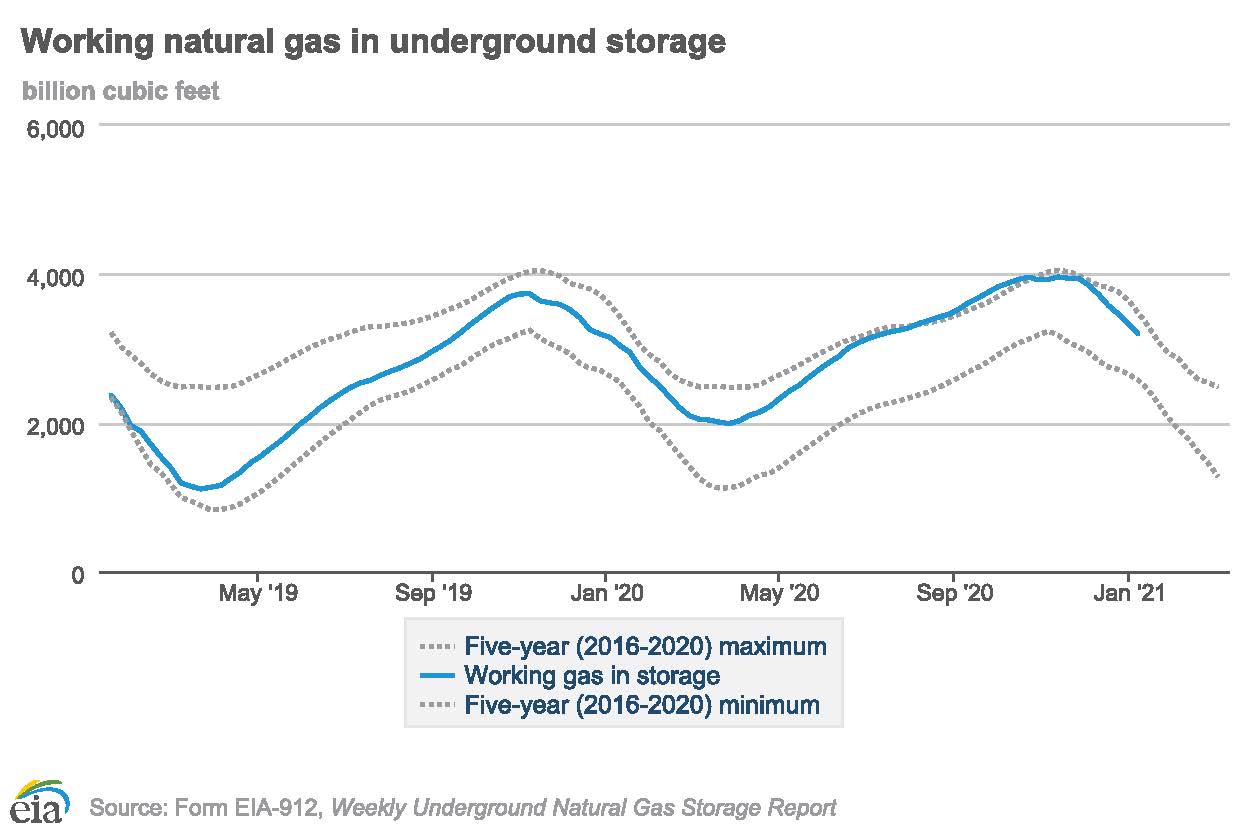

The US Energy Information Administration (EIA) publishes a Natural Gas Storage Report that includes the current volume and the change in volume during the previous weeks. Figure 1 presents how working gas in storage changed over the past two years. The figure also shows the five-year (2015–2019) maximum and minimum change during that time.

As shown in the graph, natural gas inventories see a seasonal slump before the summer, and a seasonal peak before the winter, which implies a large demand for heating and electricity during the winter season. The most-recent data of working natural gas in storage depicts that the decline in inventories this winter is less than expected compared to the past five years’ data, which suggests weaker demand, and investors may become bearish for natural gas futures prices.

Figure 1: Working natural gas in underground storage from December, 2018 up to December 16, 2020.

The winter demand for natural gas is affected by the weather, which is already hard to predict especially as more CO2 is added to the atmosphere. Demand is also affected by peoples’ daily routines, like how much time is spent at home, which has been strongly affected by the COVID-19 pandemic.

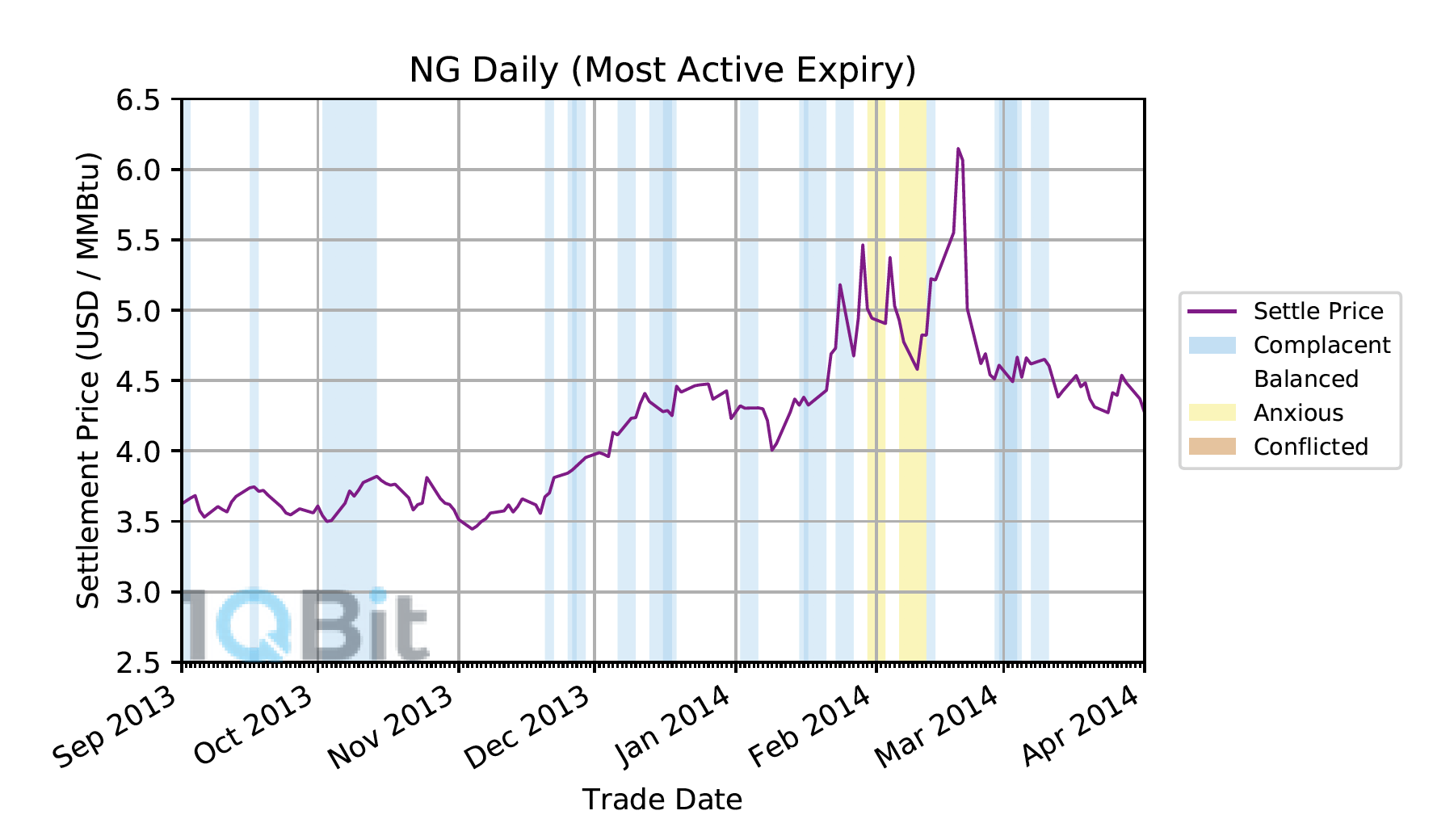

As shown in a recent 1QBit white paper on the winter of 2013–2014, a late winter cold snap led to rising prices in the natural gas spot market and nearby futures contracts, but traders looking ahead to the warmer months—and checking the storage report—saw no cause for alarm.

Figure 2: 2013–2014 Daily Settlement Prices for NG.

Takeaway Message

Divergence between the immediate price movements and the MSM sentiment state is a sign that the trader should look further into the physical market. As the winter of 2021 progresses, the EIA storage report is a good resource to be aware of, especially if the price movements and sentiment states start to look like what we saw in the winter of 2014.

As a final note, readers with an interest in energy trading may recall the negative price excursion in WTI Crude Oil back on April 20, 2020. The interim report¹ published by the US Commodity Futures Trading Commission (CFTC) identified the “unprecedented reduction in demand caused by COVID-19” and “concerns about availability of global crude oil storage” as two of the main factors. This is just one more thing for the trader to keep in mind.

For more information about the CME Market Sentiment Meter, please visit the 1QBit page on the MSM. To set up a free trial and gain access to the MSM, please contact msmsales@1qbit.com.

References

¹ Commodity Futures Trading Commission (CFTC), “CFTC Staff Publishes Interim Report on NYMEX WTI Crude Contract Trading on and around April 20, 2020,” Release Number 8315-20, (2020).