Historic levels of cold and snow left millions of people without power in Texas due to a surge in demand for electricity. In the state, the majority of electrical power (about 52%) is produced using natural gas. Texas also supplies 27% of U.S. marketed production, by far the largest share of any U.S. state. How was the demand for natural gas affected by the extreme winter weather in Texas? In turn, how did that affect the natural gas futures market?

On February 17, Texas Governor Greg Abbot mandated that “all sourced natural gas be made available for sale to local power generation opportunities before leaving the state of Texas, effective through February 21, 2021.”

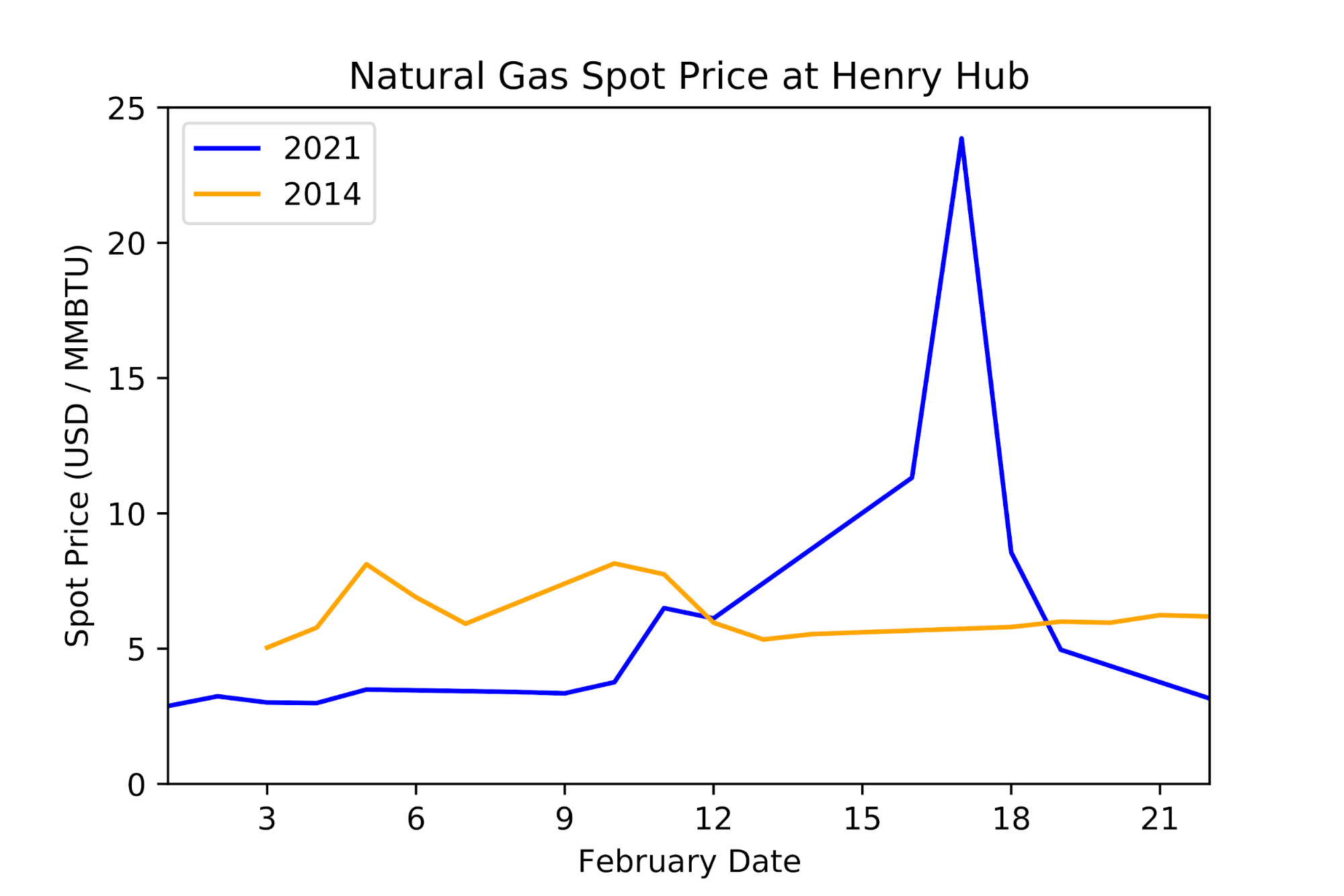

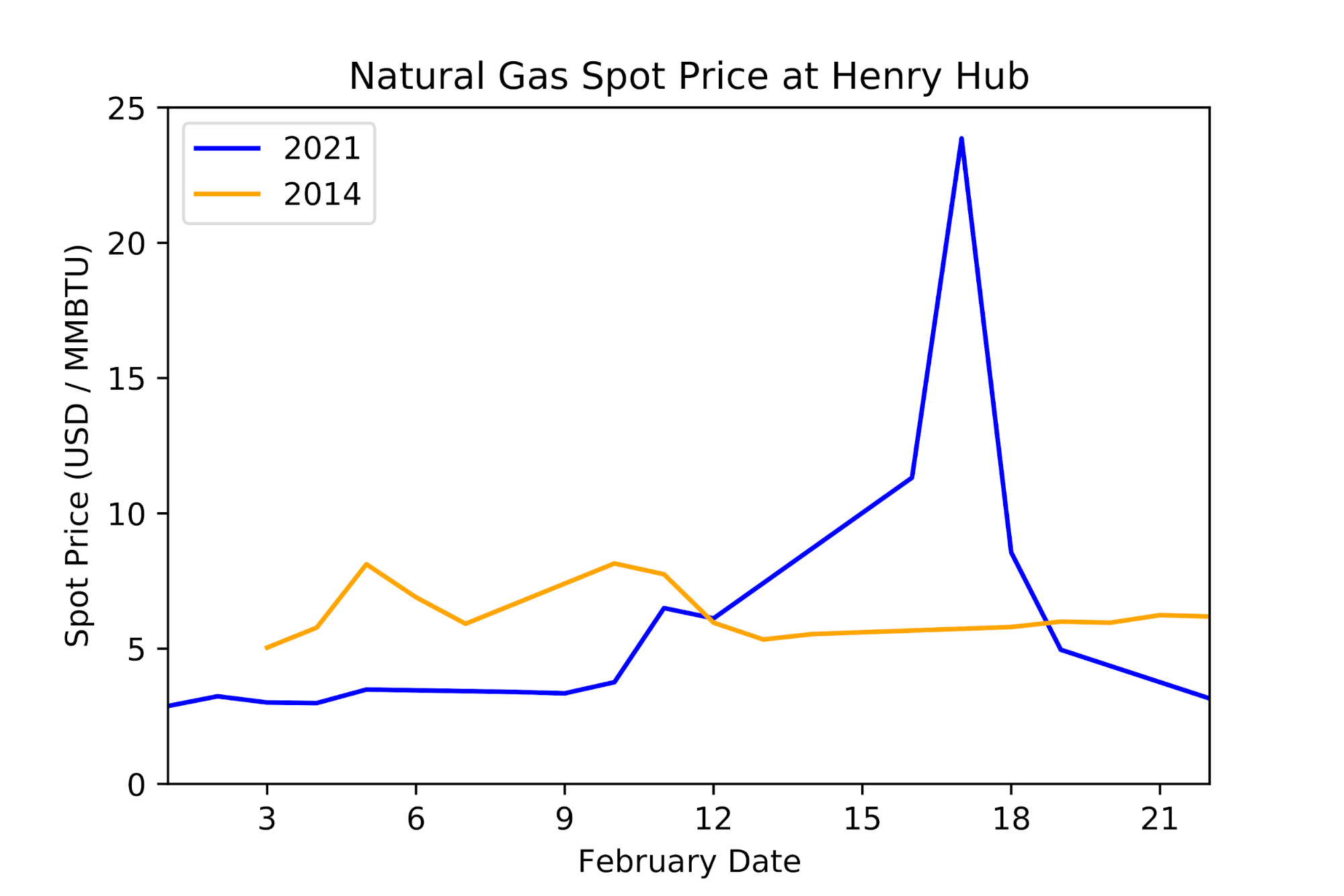

1 The mandate was rescinded two days later on February 19, but not before the spot price for U.S. natural gas at Henry Hub had surged to $23.86/MMBTU—eight times its value at the start of the month.

“The market can tell the difference between a governor’s short-lived mandate and actual reservoir levels.”

On February 22, the U.S. Federal Energy Regulatory Commission (FERC) announced that its Office of Enforcement would be “examining wholesale natural gas and electricity market activity during last week’s extreme cold weather to determine if any market participants engaged in market manipulation or other violations.”

2

How Was the Futures Market Affected?

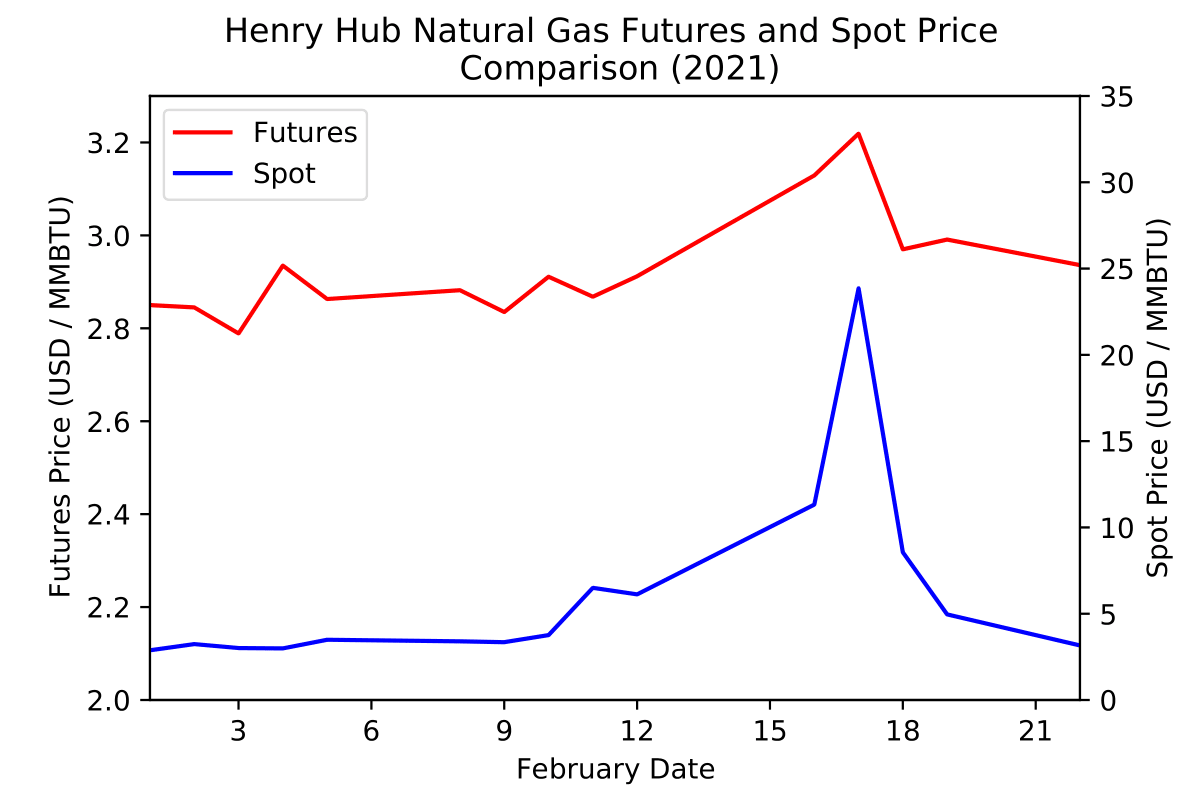

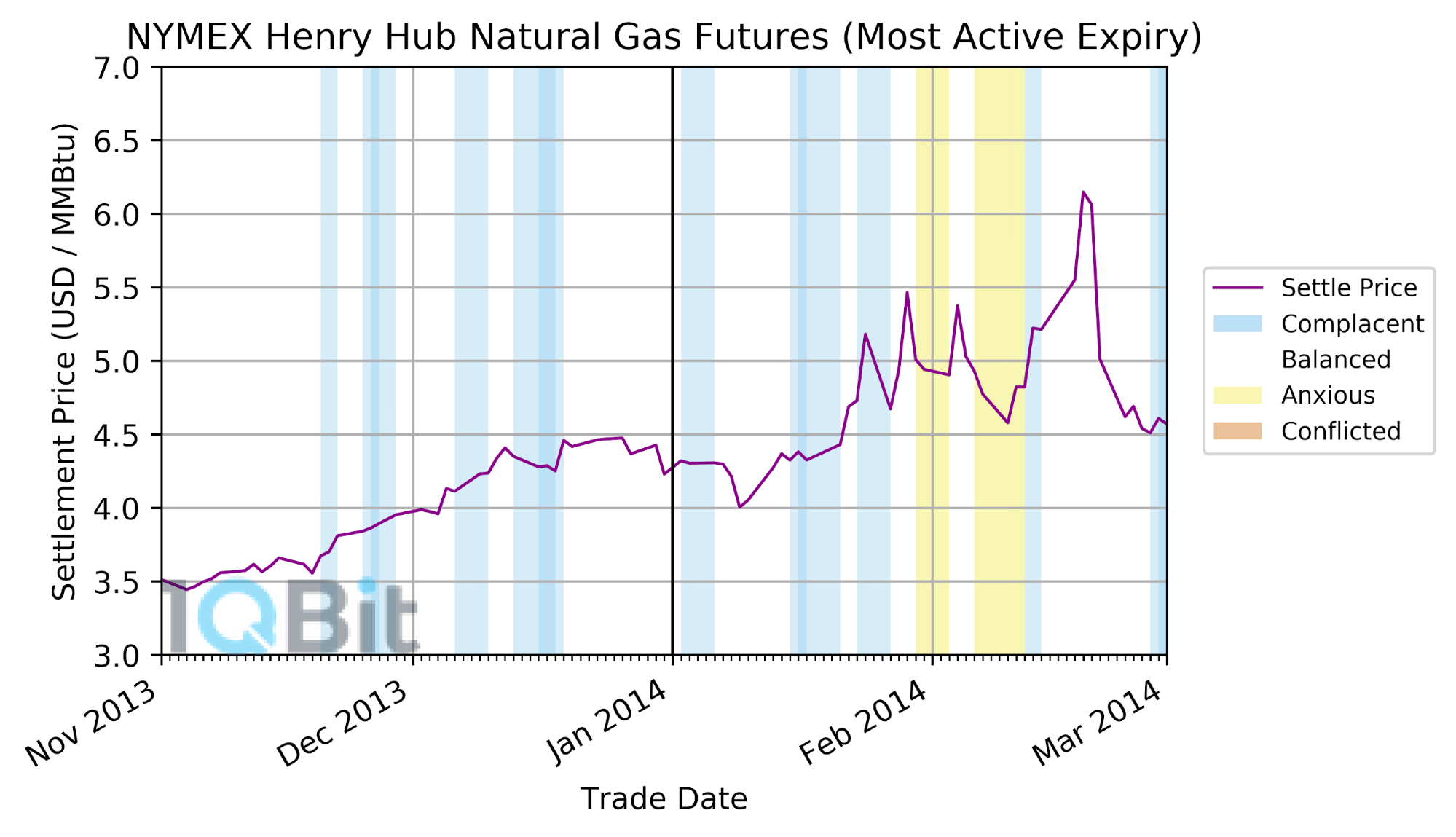

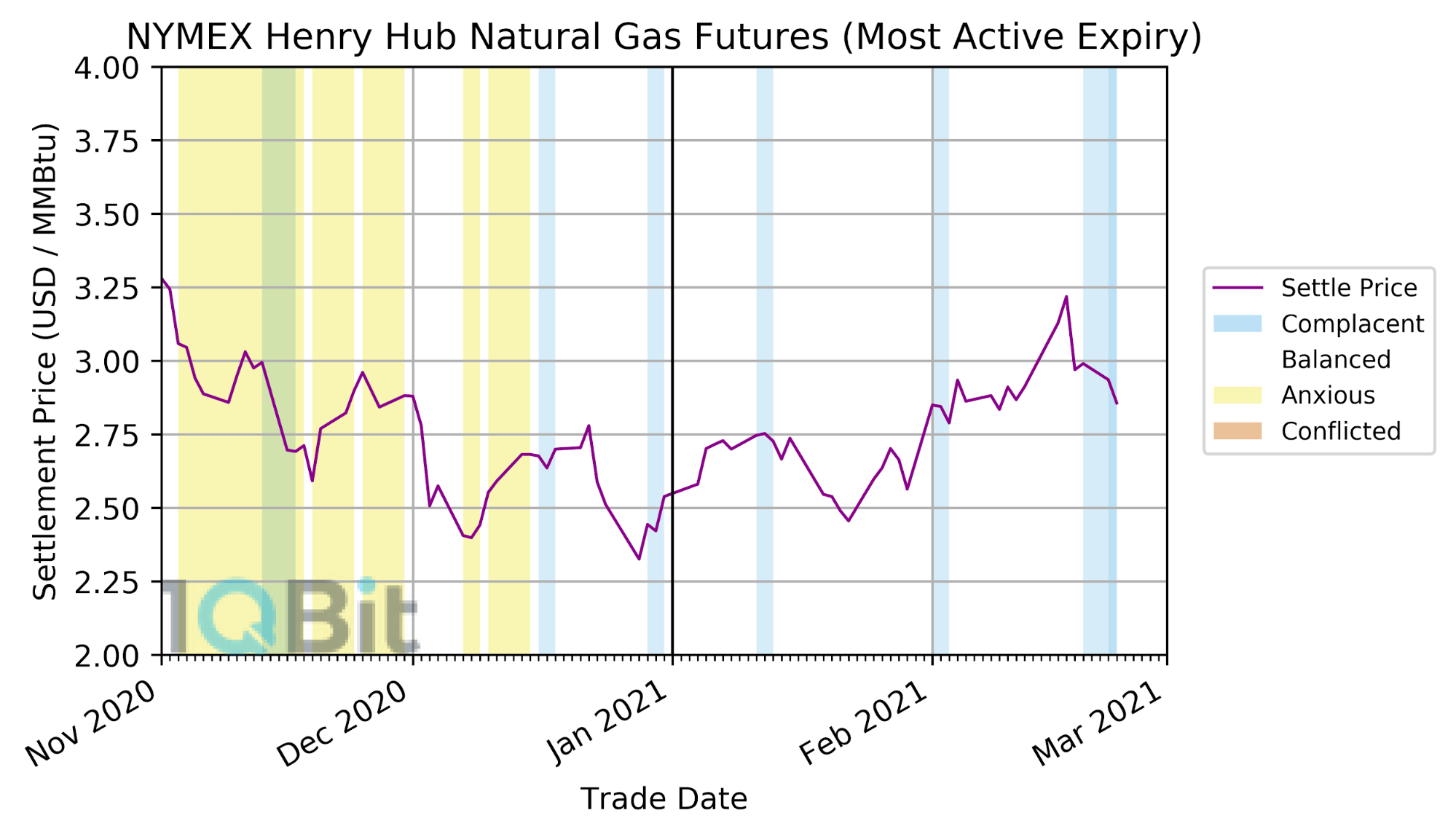

The market had its own story to tell. The price of the natural gas futures contract for March delivery rose a mere 13% from its value at the start of the month, from $2.850/MMBTU on February 1 to $3.219/MMBTU on February 17. It settled back to $3.082/MMBTU the next day. There was plenty of gas in storage, and not much to worry about as winter moved into its final few weeks.

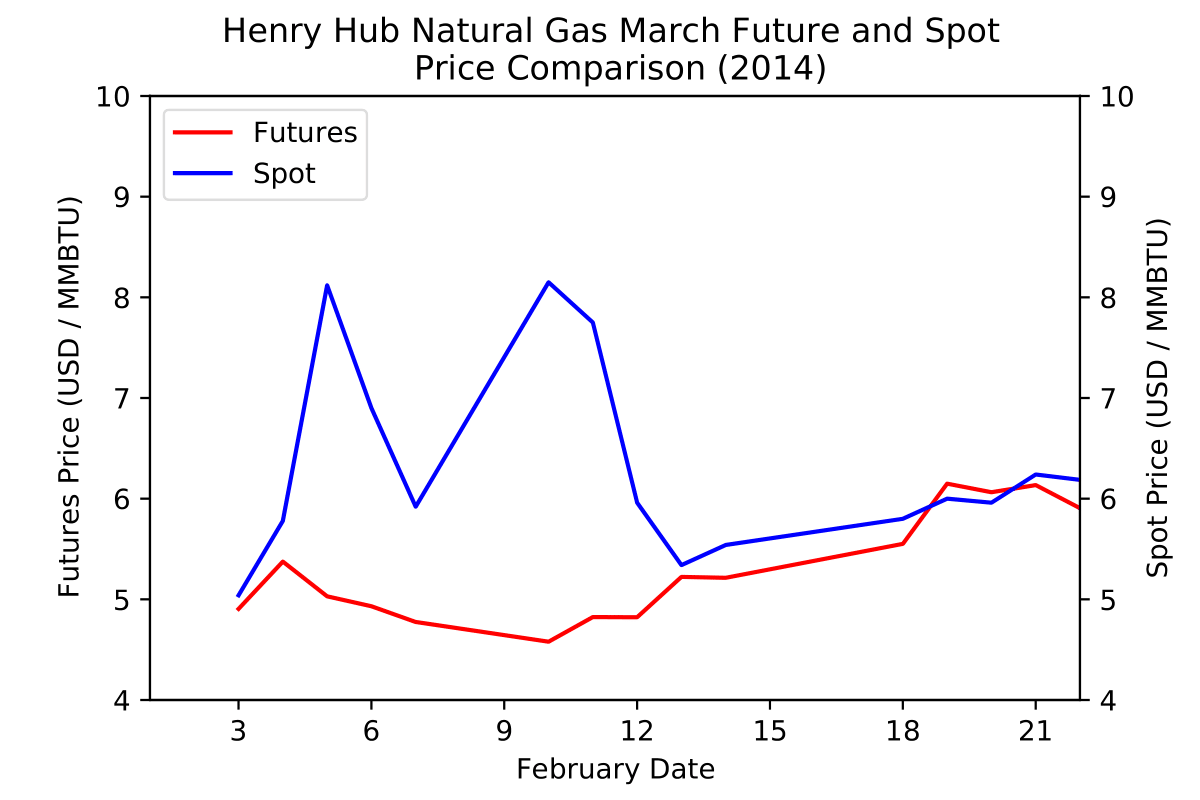

Compare this to 2014, however, where there was a similar late winter cold snap. In that year, the price of the March futures contract rose by some 25% from its value at the start of the month. This was analyzed in detail in this

white paper and an accompanying

blog post.

The difference is that, back in 2014, there had been more than one cold snap, and withdrawals of natural gas from storage had been very heavy earlier in the year. The spot price had moved around quite a lot and, by the end of February, the price of the March futures contract rose to meet it, which is normal behaviour, and an indication that prices were expected to remain high.

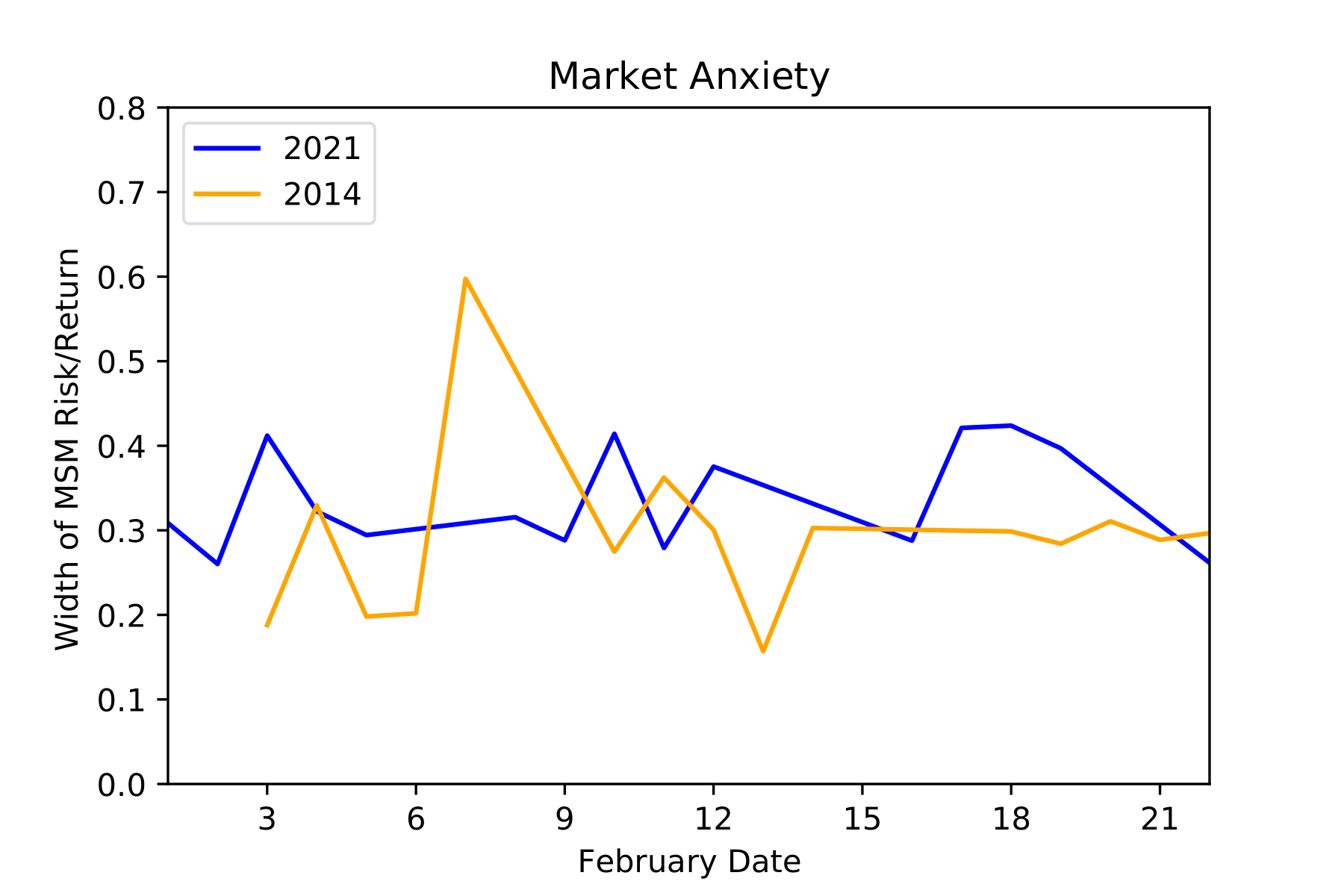

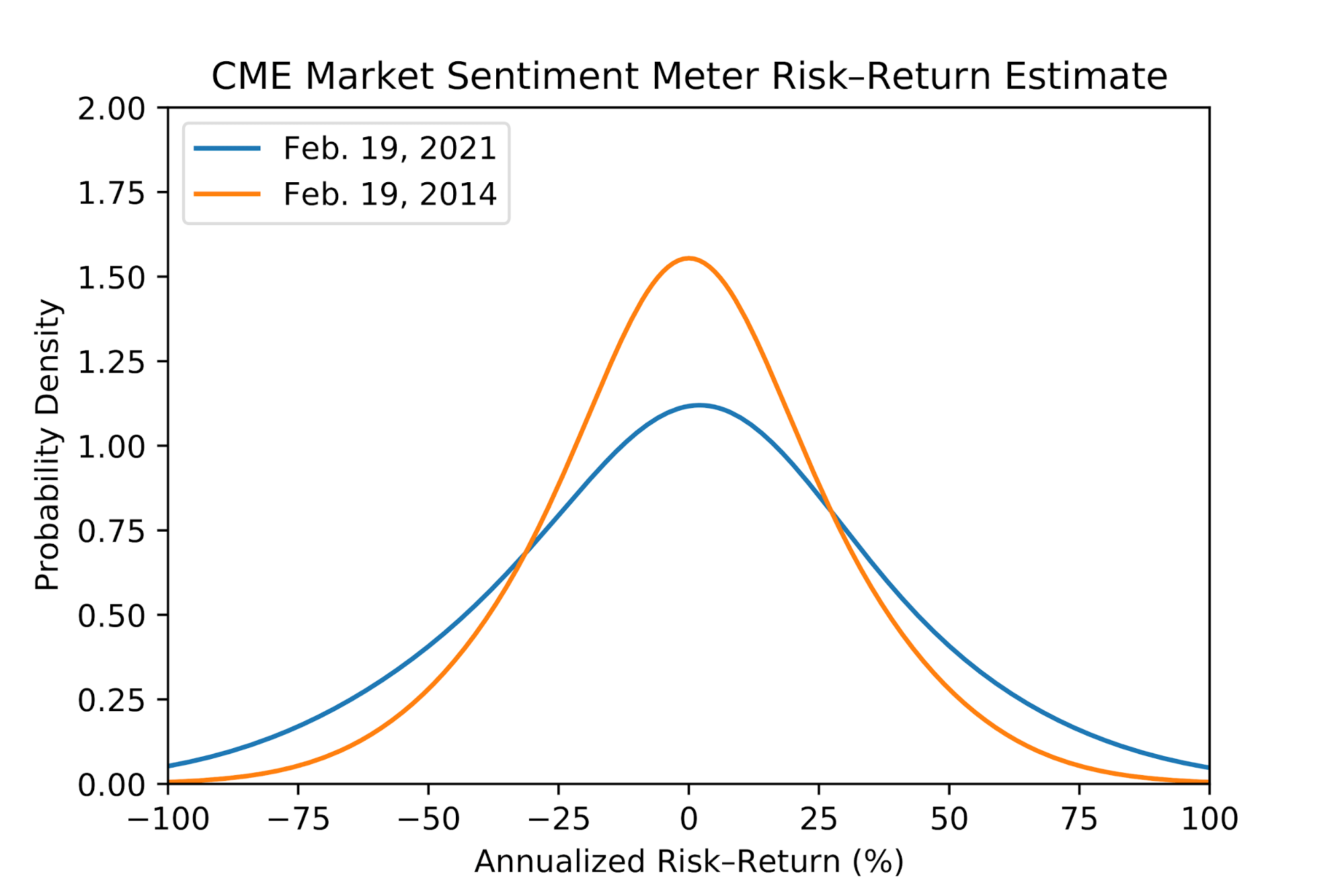

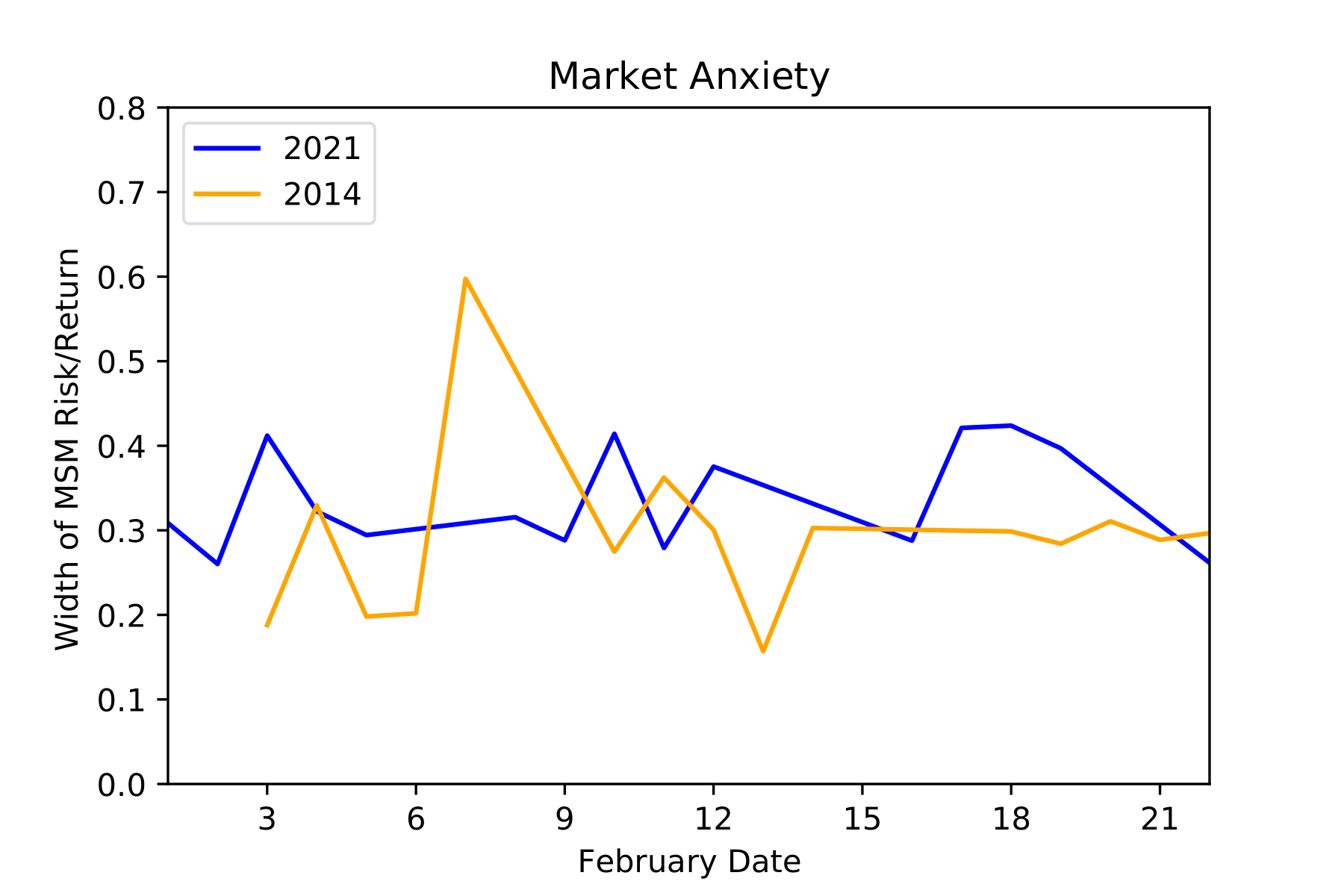

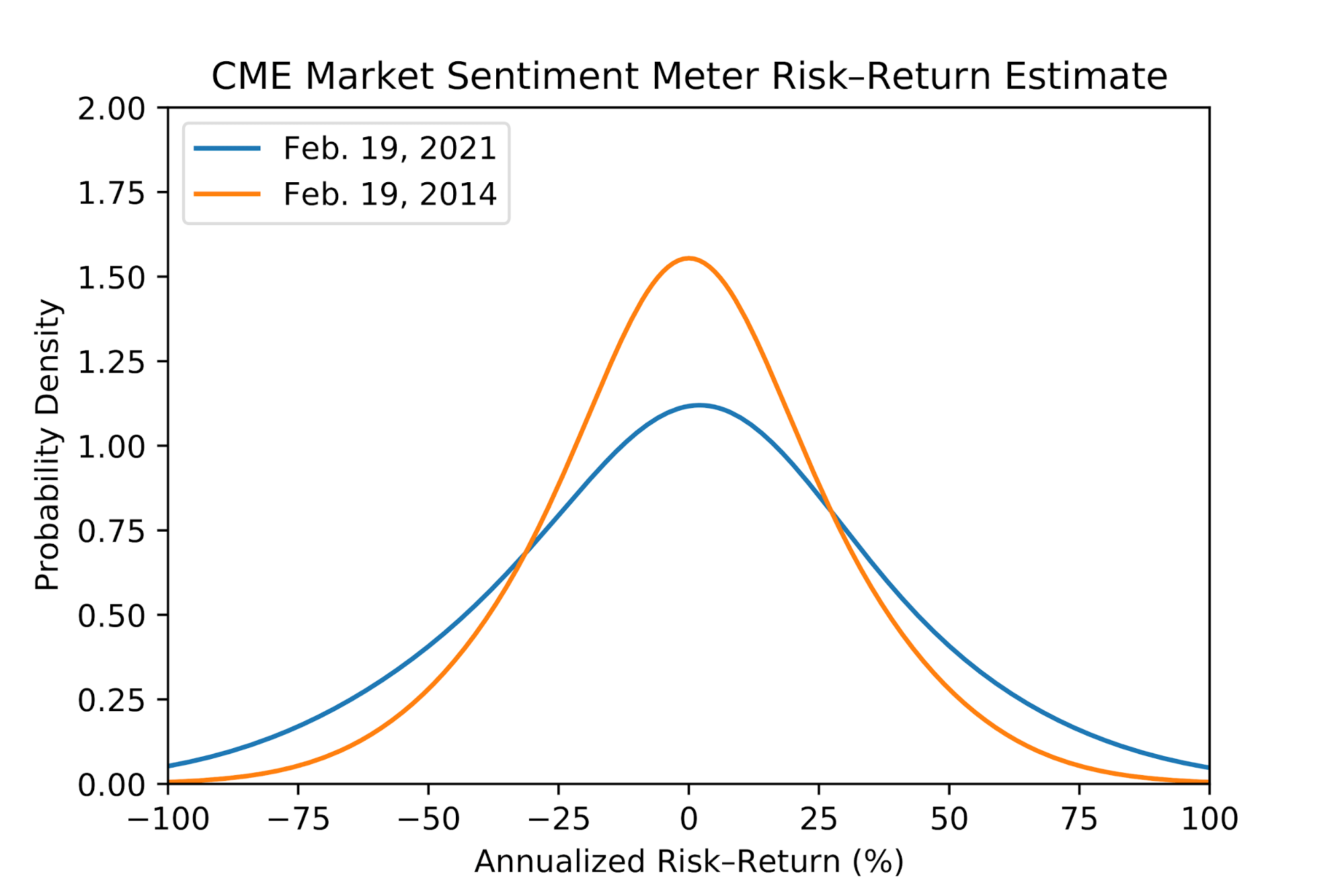

In both years, the CME Market Sentiment Meter (MSM) showed that the natural gas futures market remained largely in the “Balanced” state—the most typical market sentiment state (see this article for more detail on market states). However, for 2021, the width of the distribution tended to be larger than for 2014 despite both markets being largely Balanced.

In February of 2014, the amount of gas in storage was low but adequate. In February of 2021, the amount of gas in storage was relatively high (above the five-year average for that time of the year). The Governor of Texas walked back his mandate and the spot price fell. It will be interesting to see what the FERC makes of this when its investigation gets underway.

The slight trend toward anxiety in late February of 2021 can be attributed to two factors:

- The decline in Texas natural gas production due to freeze-offs, which occur when water and other liquids found in produced raw natural gas freeze at the wellhead and/or potentially in natural gas gathering lines near production activities, resulting in flow blockage.4

- Concern that the intervention of the Texas government might disrupt existing delivery arrangements.

The results of the FERC investigation should tell us how much of the price spike was due to these possible causes. It may also lead to new rule-making, which will be worth watching for. The market can tell the difference between a governor’s short-lived mandate and actual reservoir levels, but clarity from the Federal regulator is always helpful.

The investigation was originally announced as “non-public”, but later in the same day, the FERC announced that it would be holding a “Workshop Regarding the Creation of the Office of Public Participation”.

3 How this will affect market sentiment remains to be seen.

See the 1QBit Blog to stay informed on these developments and others, as seen through a quantitative finance lens.